News

CATL Solid-State Battery Enters Sample Verification

2025-08-19 | Eric

We have exclusively learned that CATL has increased its R&D investment in solid-state batteries this year, expanding its research team to more than 1,000 members.

CATL is currently focusing on the sulfide route and has recently entered the 20Ah sample trial production stage. According to an insider, CATL's current solution can achieve an energy density of 500 Wh/kg for ternary lithium batteries—over 40% higher than existing batteries. However, charging speed and cycle life still fall short of expectations.

Typically, trial production of solid-state battery samples begins at 1Ah, gradually scaling up the capacity of individual cells. At the 1Ah stage, the goal is to test material performance. The 10Ah stage mainly examines single-cell performance. Reaching the 20Ah stage suggests that the technical solution has been preliminarily finalized and has entered the stage of exploring production technology.

In April this year, Wu Kai, CATL’s Chief Scientist, stated at the International Battery Technology Exchange Conference that CATL had built a 10Ah solid-state battery performance verification platform and made progress in electrode materials, processes, and manufacturing equipment.

Now, with CATL moving into the 20Ah trial stage—equivalent to the single-cell capacity of soft-pack batteries used in EVs—if safety and performance challenges can be solved at this stage, the remaining hurdles will mainly be manufacturing engineering issues. These can be effectively addressed through increased manpower and more experiments.

CATL Chairman Zeng Yuqun divides solid-state battery development into nine levels. At the Power Battery Conference in September, he said CATL is currently at level 4, aiming to reach levels 7–8 by 2027 to achieve small-scale production of solid-state batteries.

CATL’s roadmap aligns with Toyota, LG Energy Solution, and Samsung SDI, slightly ahead of BYD. In September, Zeng made a rare high-profile statement, claiming CATL’s research is “second to none” compared with competitors.

Such confidence likely stems from unprecedented investment.

From Following to Betting Big, from No Target to Mass Production by 2027

Energy density is the most critical performance metric of a battery, representing efficiency. Over the past 30 years, most battery R&D efforts have focused on increasing energy density—fitting more power into the same size and weight.

From Sony and Panasonic to CATL, lithium battery energy density has improved from 120 Wh/kg to around 320 Wh/kg today. This improvement has enabled lithium batteries to enter more industries, create larger business opportunities, and drive energy transitions.

Unlike semiconductors, batteries do not follow Moore’s Law—performance does not double over time. Yet the world has never demanded as many lithium batteries as it does today. Global lithium battery production has increased tenfold in the past five years, while energy density has improved by less than 30%.

Looking ahead, liquid lithium batteries used in EVs and smartphones have limited room for improvement. The theoretical energy density limit of liquid ternary lithium batteries is 350 Wh/kg—enough to extend a smartphone’s battery life by only 30 minutes or add 50 km to an EV’s range per charge.

According to Tesla founder Elon Musk, electric passenger aircraft would only be feasible when battery energy density exceeds 450 Wh/kg.

Thus, solid-state batteries have become the industry’s recognized future form of lithium batteries.

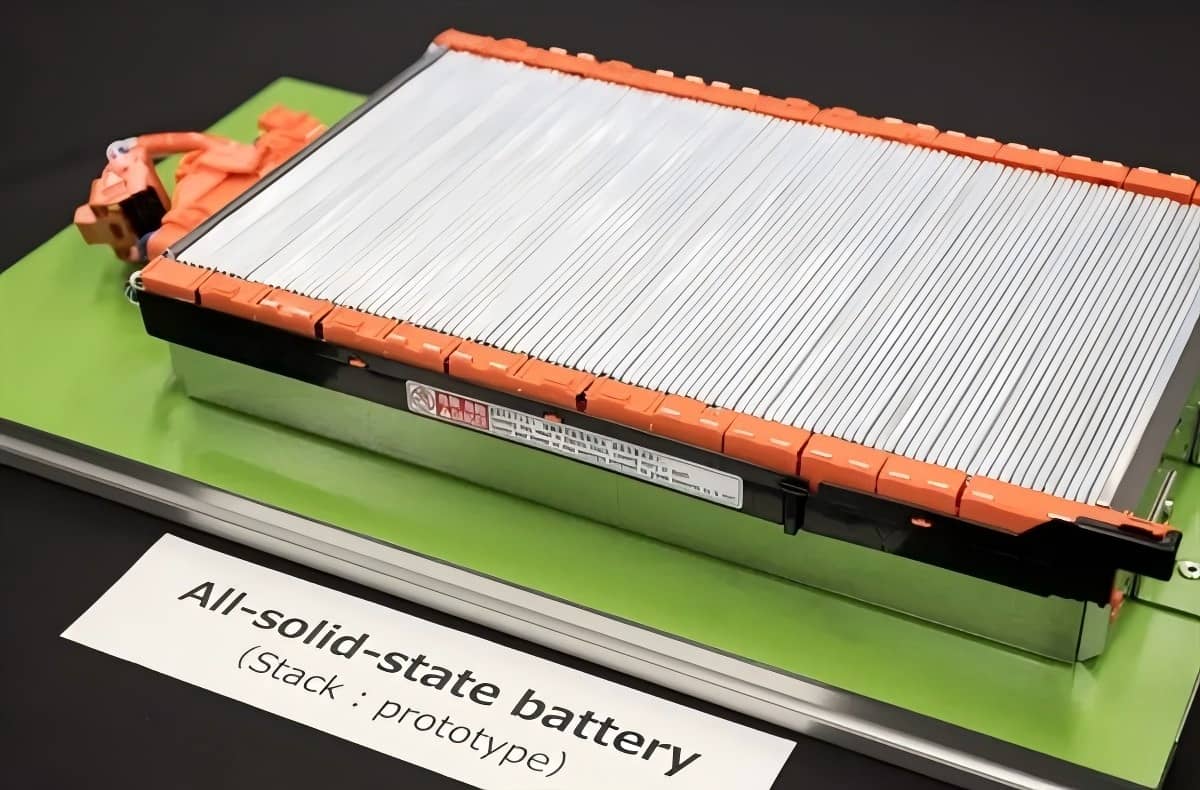

Solid-state batteries replace the liquid electrolyte (commonly lithium hexafluorophosphate) with a solid electrolyte. These are more stable and safer, allowing the use of lithium metal as the anode (instead of graphite) and high-nickel ternary materials as the cathode. This could double the energy density ceiling to over 700 Wh/kg.

Although nearly every company claims to be “developing” solid-state batteries, until this year, most large battery firms allocated only a few dozen engineers to track frontier technologies. This was mainly because liquid lithium batteries still had room for improvement, offering clearer returns and higher cost-effectiveness. Big companies also believed that even if startups made breakthroughs, they could quickly catch up by imitation.

CATL followed the same strategy in earlier years.

CATL’s research into solid-state batteries dates back to 2016, when it recruited Liang Chengdu, a scientist with a decade of experience at Oak Ridge National Laboratory, to co-lead its R&D system and spearhead the sulfide solid-state battery project.

However, a person close to CATL said Liang’s team had fewer than 100 members at that time, with the role mainly being to track cutting-edge lab and company developments and advise management. CATL did not significantly increase investment in solid-state R&D until the end of 2022.

Executives had been cautious about solid-state battery prospects. Wu Kai once said, “If Toyota claims it can mass-produce solid-state batteries today, I’d be skeptical. No one in the industry currently has that ability. As for 2027, even as a scientist, I can’t say for sure.”

But in March this year, Wu shared CATL’s progress at a technical forum, and six months later, Zeng revealed the 2027 small-scale production target.

Reinventing Every Component of the Battery

CATL, like Toyota, is betting on the sulfide route, which Wu Kai says offers the highest performance ceiling and fastest path to mass production. Current solid-state battery routes include sulfides, oxides, and polymers, each with drawbacks. Polymers require heating to 60°C for sufficient conductivity. Oxides have low conductivity. Sulfides, while similar to liquids in conductivity, easily oxidize and release toxic gases. Recently, halide electrolytes have also emerged, with BYD focusing on them.

But sulfide solid-state batteries face four major challenges: poor interface contact between electrodes and solid electrolytes, lithium dendrite formation, sulfide instability in air, and manufacturing difficulties. CATL claims to have found solutions at the 10Ah stage, such as multi-layer coatings on electrodes, self-developed binders to maintain conductivity, and equipment that applies 500 MPa uniform pressure to cells.

CATL has achieved a cathode capacity of 230 mAh/g and extended cycle life to 6,000 cycles, though stability remains an issue. For dendrites, CATL proposes flexible “sponge-like” fillers and alloy surface treatments. They also improved sulfide electrolytes to remain stable at -40°C dew points, lowering production costs.

Additionally, CATL has made breakthroughs in dry electrodes and isostatic pressing, though engineering challenges remain, such as ensuring long-term pressure on cells and developing new packaging materials.

A startup executive said that if cost is no concern, CATL could achieve around 0.5 GWh production capacity by 2027, enough for thousands of EVs. CATL’s unprecedented investment may accelerate progress.

CATL invests half its net profit annually into battery R&D. However, as progress slowed in recent years, returns diminished, and competitors seized market share through lower prices. CATL’s share in China dropped from 55% to around 40%. This forced CATL to push technological boundaries and seek new growth drivers.

Popular Articles

Contact Details

Worktime : Monday to Friday 9am - 6pm (HKT)

WhatsApp/Wechat/Mobile : +86XXXXX

Email : info@lifepo4cellstore.com