Blog

The Difficult Birth of 4680: Only Tesla Would Dare Make Batteries This Way

2025-08-17 | Eric

In 2006, Elon Musk unveiled an ambitious vision: to manufacture increasingly affordable electric vehicles that would replace gas-powered cars and accelerate the world's transition to sustainable energy.

China is rapidly approaching this goal. The average selling price of new energy vehicles here has dropped from over 200,000 yuan last year to under 180,000 yuan, now on par with conventional vehicles, with further declines expected next year. Emerging automakers like NIO and AITO, which originally targeted the 250,000-400,000 yuan market, are also introducing more affordable models. The China Passenger Car Association estimates that in 2024, 42 out of every 100 cars sold in China will be new energy vehicles.

Yet Tesla, the company that helped initiate this transformation, is conspicuously absent. For at least the next 18 months, Tesla won't have any new models in the Chinese market. Its Model 3 and Model Y no longer enjoy the price advantage they had at launch. Tesla's only new global model, the Cybertruck, will have a production volume of just 125,000 units in 2024, primarily delivered in the U.S. This futuristic-looking pickup starts at approximately 430,000 yuan, 1.5 times its initially announced price in 2019.

Tesla's previously announced mass-market model, priced below 150,000 yuan, won't enter mass production until the second quarter of 2025 at the earliest. By then, the Model 3 will have been on the market for eight years and the Model Y for five, with only minor facelifts during that period.

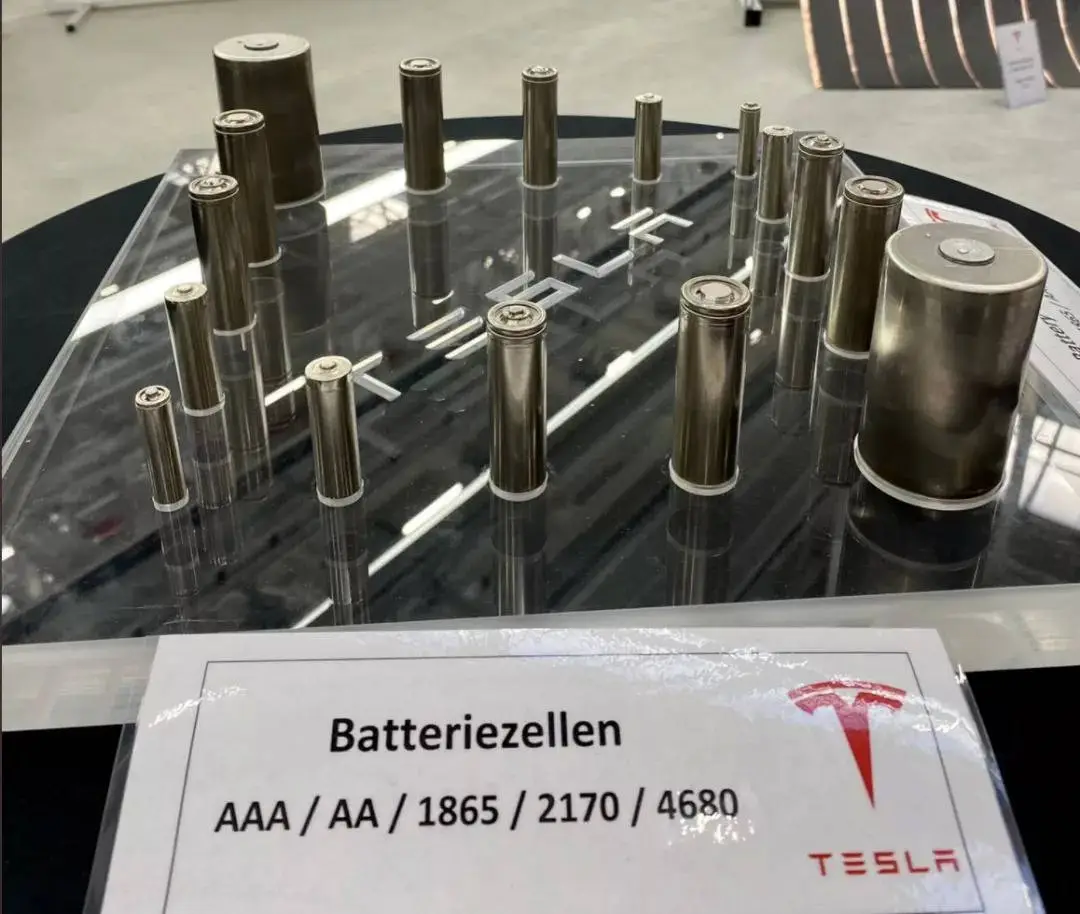

A major reason for Tesla's five-year product vacuum is the multi-year delay in mass-producing its 4680 batteries.

Reinventing Batteries and Battery Factories

Tesla unveiled the 4680 battery in 2020. During early development, Musk believed battery manufacturing was too inefficient and that Tesla could reinvent the process, abandoning conventional methods to reduce costs by 50%.

Originally slated for mass production in 2021, the 4680 only reached small-scale production by mid-2023. Tesla's Texas factory produced just 10 million 4680 cells over four months—enough for only 12,000 Cybertrucks.

We've learned that in late 2023, Tesla began outsourcing electrode production to Chinese battery companies to meet output requirements. By Q2 2024, Panasonic will start supplying 4680 batteries to Tesla, but capacity will only suffice for about 60,000 vehicles.

From the Roadster to Model 3 to Model Y, Tesla has applied "first principles" thinking to each new generation: questioning industry conventions to determine their validity, then using physics fundamentals to find simpler, cheaper solutions that achieve what experts deem impossible. The 4680 continues this approach.

The biography "Elon Musk" repeatedly describes this first-principles process. For SpaceX rockets, Musk challenged authority by proposing cheaper stainless steel instead of carbon fiber—ultimately building the Starship for just 2% of NASA's moon mission budget.

Tesla and Musk's other ventures often use first principles to bypass tradition, proving conventional wisdom wrong while achieving technological leadership.

But with the 4680, Tesla's approach has stumbled. This battery determines Tesla's next-gen vehicle capacity and pricing, yet its production timeline and performance have fallen short of initial targets. This reveals another side of first-principles thinking: when tackling complex innovation, starting from fundamentals often marks just the beginning of a grueling journey.

Perfect Design, Difficult Manufacturing

Larger cells, eliminating the "idiotic" wet-coating-and-drying process—these obvious improvements went unimplemented for decades due to immense challenges.

The first hurdle was process redesign. Unlike automotive assembly, battery manufacturing involves material transformation where each step's output becomes the next step's input. Changing one step requires modifying adjacent ones.

Adopting dry electrode technology meant making 50% of the process "dry," with far stricter environmental and precision controls than other steps.

Wet electrode coating—like spreading cream—applies binder-containing slurry uniformly onto metal foil at 30-micron thickness. CATL and others have achieved 100 meters/minute coating speeds through billions of iterations.

Dry electrode is more like sprinkling sand. To make it stick uniformly, Tesla developed new binders that fibrillate under pressure, creating a "cotton candy" surface. But binder ratios proved tricky: too much reduces energy density and ion flow; too little weakens adhesion.

By mid-2023, Tesla's 4680 samples achieved 88% first-cycle efficiency (vs. 85% for partners), still below mainstream batteries' 92%. This suggests ~1,000 cycles versus 2,500+ for conventional cells.

Material development solved only ~20% of production challenges. Equipment came next.

Dry electrode rollers need perfect pressure to fibrillate binders. Lab-scale success doesn't translate to mass production's continuous precision. Tesla's patents show three rollers, but suppliers report seven were eventually used—increasing precision but complicating calibration.

Even Tesla, known for manufacturing breakthroughs, faced this inefficiency spiral. Debugging requires endless trial-and-error, with changes cascading through multiple steps. Removing "excess" wet processes proved far harder than Musk anticipated.

Tesla designed equipment itself, then outsourced production. But according to suppliers, this created disconnects: "Equipment engineers didn't understand processes, Tesla didn't understand equipment, and suppliers took forever to build functional—but still inadequate—machines."

By 2022, some initial 4680 equipment vendors had withdrawn. One major supplier delivered a full production line and sent a 50-person team to Texas before pulling out in late 2022.

Another hurdle was welding. The 4680's tabless design multiplied weld area, increasing defect risks. "Tesla still hasn't defined weld quality standards," said a supplier. The company also faced yield challenges in laser sealing.

By late 2023, 4680 yields reached just 92%—below the 95% commercial viability threshold. Production speed was 85 cells/minute versus an expected 350. Faster runs revealed new quality issues.

"Even 0.001% dust causes shorts. Labs don't expose such edge cases, but factories do. You keep discovering new failure modes," said Tesla's battery lead Drew Baglino.

Today, Tesla's 4680 process remains unstable. "Issues span both production and design. We're often debugging one version while starting the next," an engineer shared.

Only Tesla Would Dare

Industry estimates suggest abandoning dry electrodes could still cut Model Y costs by ~8% (20% battery savings)—not half Musk's goal but impressive nonetheless, requiring competitors like Panasonic or CATL three years to match.

Yet Tesla persists, even delaying Cybertruck and next-gen vehicles. In Musk's vision, the 4680 isn't for today's 2-million-vehicle Tesla but tomorrow's 20-million.

Only cheaper batteries enable Tesla's $25,000 car. By March 2023, Tesla completed its design and advanced gigacasting—making the 4680 the final obstacle.

No automaker but Tesla would stake its expansion on such ambitious technology, magnifying both risk and reward.

First-principles thinking works when old constraints no longer exist—like SpaceX's 33-engine design, impossible in the 1970s but feasible with modern computing. But it can't transcend era limitations. When current technology falls short, progress comes slowly and expensively.

Model 3's 2017 "production hell" showed this when over-automation backfired. Battery manufacturing presents similar complexity—interlinked steps where removing "unnecessary" wet processes requires rebuilding half the production chain.

Even after lab success, scaling to billions of cells demands consistent yields and cost control. Multiple sources predict Tesla will mass-produce 4680s by 2025, but performance will fall far short of 2020 targets: current energy density is 265Wh/kg (20% below projections), giving Cybertruck 547km range versus 800km promised.

Three years post-launch, Tesla has achieved just one-third of its goals, mastering dry graphite anodes but still facing harder dry silicon anodes and cathodes.

Commercially, being slow can be fatal. Tesla's product cadence has faltered during a critical growth phase.

Technologically, however, Tesla has blazed trails: the 4680 standardized large cylindrical cells, while CATL and others now explore dry electrodes for separators and beyond. The 4680 may spark a battery manufacturing revolution—if Tesla can endure the painful gestation.

Popular Articles

Contact Details

Worktime :Monday to Friday 9am - 6pm (HKT)

WhatsApp/Wechat/Mobile :+8613645616165

Email : info@lifepo4cellstore.com